BECU · 2025

Reimagining financial journeys

Designing Trust at Scale

TIMELINE

16 weeks

ROLE

Product Designer

TEAM

1 Strategist

2 Product Designers

2 Researchers

SKILLS

Concept Design

Strategy

Web Design

Problems & Goals

Information is hard to find

Excessive jargon and fragmented navigation overwhelms users, resulting in confusion and low tree test success.

GOAL 1

Improve Wayfinding

Redesign navigation and key journeys so users can easily find information and reduce reliance on support channels.

High traffic to Support Center

Because users can’t locate key information on the site, they turn to the Support Center, driving high traffic.

GOAL 2

Enhance Self-Service

Empower users with contextual support and tools to resolve common issues and provide clear guidance.

Product-first journeys

Current credit card flows prioritize products over customer needs, creating friction and lowering confidence.

GOAL 3

Needs-based journeys

Shift to needs-based guidance that builds trust and supports financial goals.

Strategy

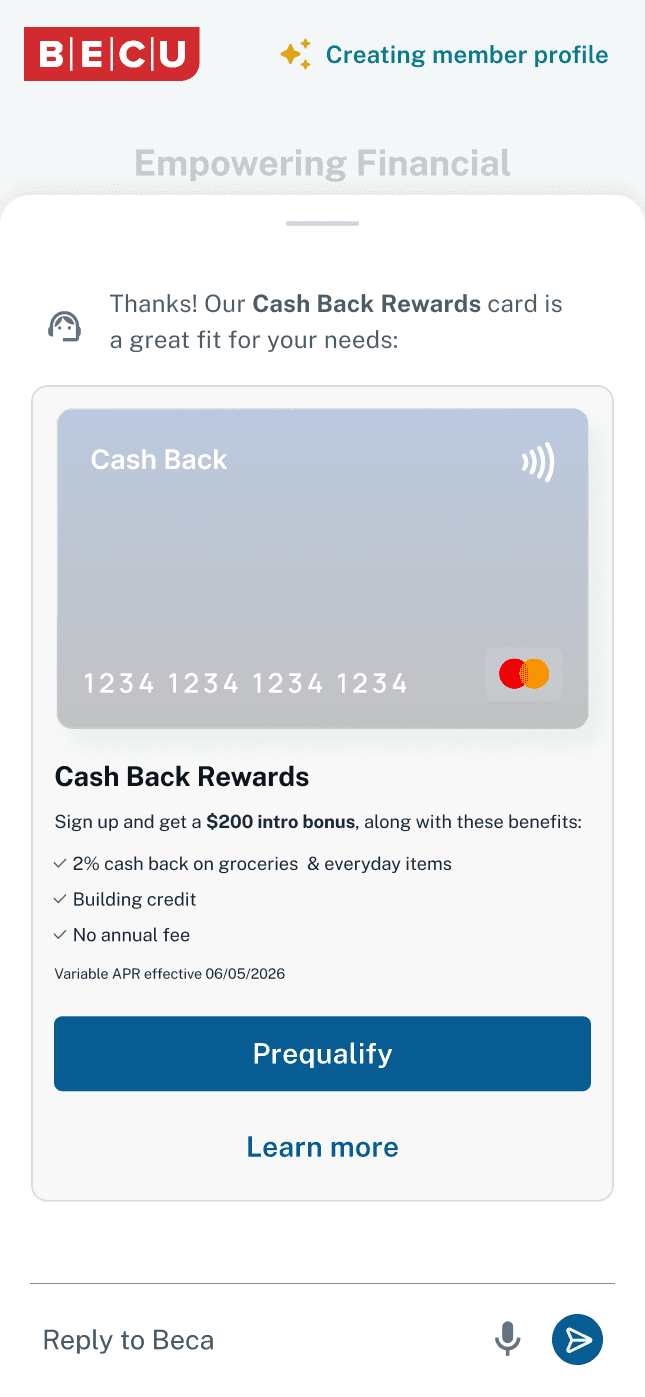

Digital Front Door

ENTRY

A mobile-first entry point where users first engage with BECU.

Member Activation

ACTION

Turning passive users into engaged participants with clear decision paths and guidance, driving adoption.

Personalization

RELATIONSHIP

Tailoring experiences to each users financial goals to build trust, retention, and deeper value.

Vision

To reimagine the future of BECU.org

My role was to explore what future financial interactions could feel like for customers, grounded in real user data, trust, and clarity.

RESEARCH

Aligning on stakeholders needs

Competitive Analysis

I benchmarked BECU against industry standards to identify trends, best practices, and opportunities for differentiation.

Stakeholder Interviews

I engaged with 12 internal stakeholders to clarify business goals, uncover gaps, and ensure alignment across teams.

Discovery Interviews

I helped moderate research sessions to understand motivations, needs, and barriers in selecting credit cards.

Card Sorting

I ran card sorting to reveal user mental models and reorganize navigation to match their expectations.

KEY FINDINGS

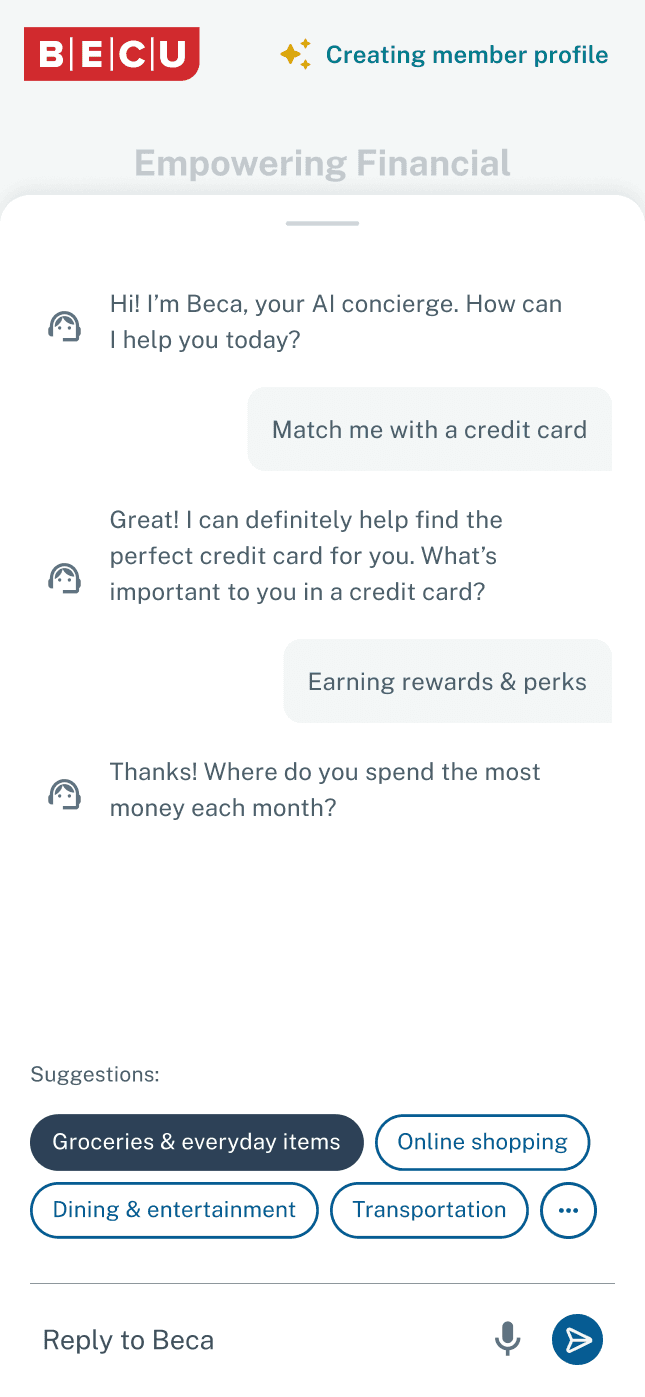

Building trust through clear product value

01

Customers are seeking financial security, using credit cards as tools to stretch their budget and offset rising inflation costs.

02

Customers desire clear, jargon-free information and personalized guidance to navigate a complex credit card landscape. They usually stick to banks they already have trust with.

03

The business needs a website that showcases value, builds trust, and drives acquisitions.

Design Principles

These principles served as guardrails, grounding every design decision in member needs, research insights, and a unified product vision.

01

Goal-Driven Journeys

Design needs-based paths that reflect real financial goals and help users make confident, financially conscious decisions.

02

Trust Through Transparency

Build credibility with clear language, honest signals, transparent fees, and visible community impact.

03

Contextual Support

Provide timely guidance based on user context, reducing reliance on the Support Center through proactive help + tools.

04

Clarity First

Show product information upfront and without jargon so users can quickly grasp value and make informed decisions.

05

Lead With Member Value

Communicate the distinct benefits of a member-focused + community-driven credit union dedicated to financial well-being.

IDEATION WORKSHOPS

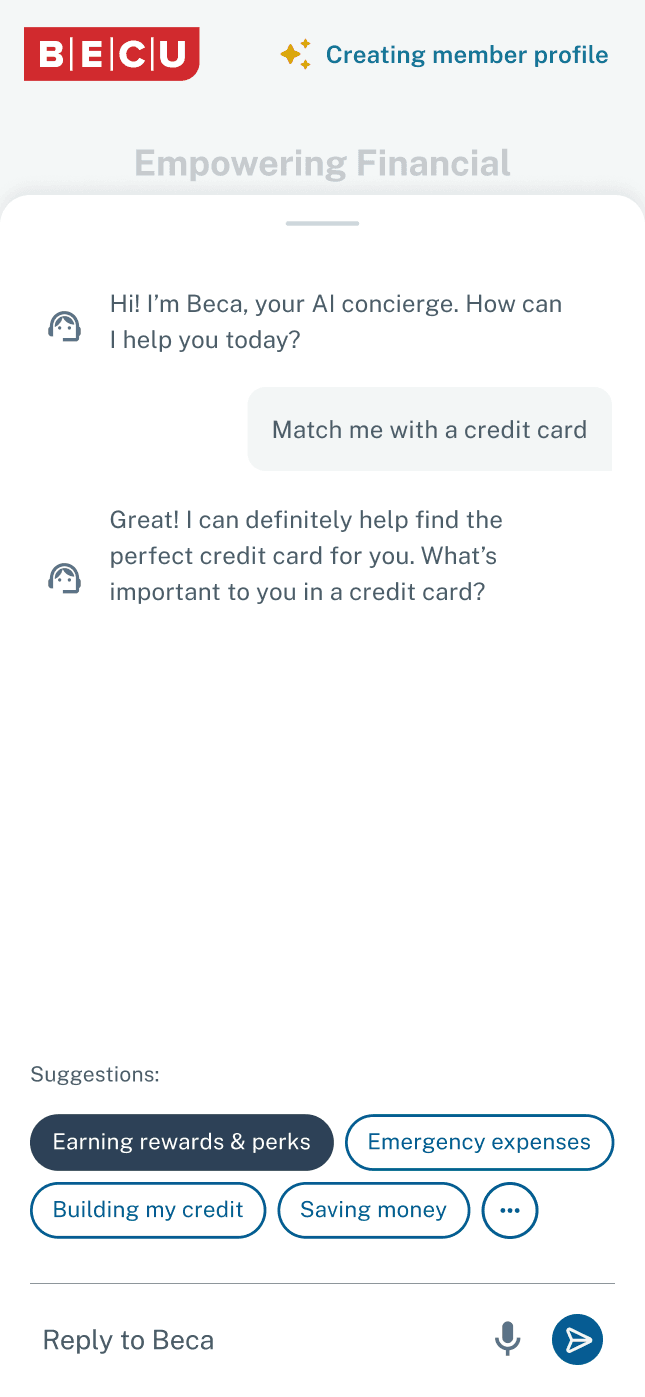

Co-creating the Product Discovery Journey

Empathy Mapping

Mapped motivations, pain points, and goals for Members + Prospects.

How Might We

Framed each journey step into questions to inspire creative solutions.

Crazy 8’s

Collectively generated rapid sketches and shared a wide range of ideas.

PERSONA

Prospective Customer

Anita, 36

IT Recruiter • Seattle

Prospect

“Show me how this card makes every dollar work with clear cash back on my everyday spend.”

About

Financially stable but cautious

Maximizes value through rewards and bonuses

Researches online channels for best offers and comparisons

Goals:

Maximize cash back on spending to offset rising costs

Maintain/improve strong credit score

Redeem points easily to reduce bills

Needs:

Fast process: Prequalification, applications, instant virtual card

Clear information: Rates, fees, and card benefits

Trust + Support: Strong customer service reputation, quick access to support and knowledgeable reps

Income:

$120K

Credit profile:

Prime (~ 700–780)

Channels:

Devices:

PRIMARY JOURNEY

Product Discovery

The first journey was focused on Product Discovery, where I mapped how Prospects search for and evaluate a new credit card based on previous research.

Outcomes & Impact

Request a case study

Want to learn more about this project?

Get in touch to request a case study.

Get in touch

Next project

Project Title